1. Rolling out our model

Exceptional financial strengthExceptional financial strength

The Group’s financial strength is based on a high level of equity that provides us with a safety buffer in the event of difficulties. The Group also has a high level of liquidity reserves, which it can use at any time and notably with the ECB.

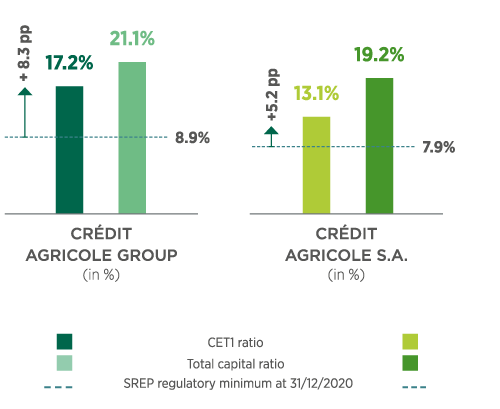

At 31 December 2020, the solvency level of the Group remained high, with a phased-in Common Equity Tier 1 (CET1) ratio of 17.2%, up by a strong 1.3 percentage point from end-December 2019. The Group benefits from a comfortable 8.3 percentage point margin between the level of its CET1 ratio at 31 December 2020 and the SREP requirement set at 8.9% by the regulator.

Likewise for Crédit Agricole S.A., the phased-in CET1 ratio stood at 13.1% at 31 December 2020, up by +1.0 percentage compared to end-December 2019, and above the SREP requirement of 5.2 percentage points. The ratio integrates the impact of the dividend payment of €0.80 per share for 2020.

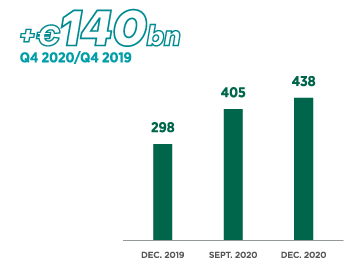

GROUP LIQUIDITY RESERVES

(in € billions)

The liquidity analysis is conducted on Crédit Agricole Group scale. The Group’s liquidity reserves, at market value and after haircuts, totalled €438 billion at 31 December 2020, up €34 billion com-pared to end-September 2020 and up €140 billion from 31 December 2019. They cover short-term debt 4x over (excluding the replacements with Central Banks).

PHASED-IN SOLVENCY RATIOS

(in %)

| GROUPE CRÉDIT AGRICOLE (in %) | CRÉDIT AGRICOLE S.A. (in %) | |

|---|---|---|

| CET1 ratio | CET1 ratio GROUPE CRÉDIT AGRICOLE (in %) CET1 ratio GROUPE CRÉDIT AGRICOLE (in %) 17.2 % | CET1 ratio CRÉDIT AGRICOLE S.A. (in %) CET1 ratio CRÉDIT AGRICOLE S.A. (in %) 13.1 % |

| Total capital | Total capital GROUPE CRÉDIT AGRICOLE (in %) Total capital GROUPE CRÉDIT AGRICOLE (in %) 21.1 % | Total capital CRÉDIT AGRICOLE S.A. (in %) Total capital CRÉDIT AGRICOLE S.A. (in %) 19.2 % |

| SREP regulatory minimum 31/12/2020 | SREP regulatory minimum 31/12/2020 GROUPE CRÉDIT AGRICOLE (in %) SREP regulatory minimum 31/12/2020 GROUPE CRÉDIT AGRICOLE (in %) 8.9 %, + 8.3 pp | SREP regulatory minimum 31/12/2020 CRÉDIT AGRICOLE S.A. (in %) SREP regulatory minimum 31/12/2020 CRÉDIT AGRICOLE S.A. (in %) 7.9 %, + 5.2 pp |

At 31 December 2020, the fully loaded CET1 ratio of Crédit Agricole Group was 16.9% and that of Crédit Agricole S.A. 12.9%.

THE INTERNAL SOLIDARITY MECHANISM

In terms of solvency, Crédit Agricole Group is best-in-class among comparable European banks, with a phased-in CET1 ratio of 17.2% at 31 December 2020. This greatly exceeds the minimum regulatory requirement (8.9% at 31/12/2020). In accordance with the French Monetary and Financial Code, Crédit Agricole S.A., as the corporate centre of the Crédit Agricole network, is responsible for taking all the necessary measures to ensure the solvency and liquidity of each member of the Crédit Agricole network, chief among them the Regional Banks and Crédit Agricole Corporate and Investment Bank (CIB). Crédit Agricole S.A. also acts as the central body for the Regional Banks and in this capacity can intervene when refinancing is necessary.